Cox–Ingersoll–Ross model

In mathematical finance, the Cox–Ingersoll–Ross model (or CIR model) describes the evolution of interest rates. It is a type of "one factor model" (short rate model) as it describes interest rate movements as driven by only one source of market risk. The model can be used in the valuation of interest rate derivatives. It was introduced in 1985 by John C. Cox, Jonathan E. Ingersoll and Stephen A. Ross as an extension of the Vasicek model.

Contents |

The model

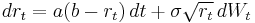

The CIR model specifies that the instantaneous interest rate follows the stochastic differential equation, also named the CIR process:

where Wt is a Wiener process modelling the random market risk factor.

The drift factor, a(b − rt), is exactly the same as in the Vasicek model. It ensures mean reversion of the interest rate towards the long run value b, with speed of adjustment governed by the strictly positive parameter a.

The standard deviation factor,  , avoids the possibility of negative interest rates for all positive values of a and b. An interest rate of zero is also precluded if the condition

, avoids the possibility of negative interest rates for all positive values of a and b. An interest rate of zero is also precluded if the condition

is met. More generally, when the rate is at a low level (close to zero), the standard deviation also becomes close to zero, which dampens the effect of the random shock on the rate. Consequently, when the rate gets close to zero, its evolution becomes dominated by the drift factor, which pushes the rate upwards (towards equilibrium).

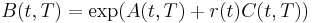

Bond pricing

Under the no-arbitrage assumption, a bond may be priced using this interest rate process. The bond price is exponential affine in the interest rate:

Extensions

Time varying functions replacing coefficients can be introduced in the model in order to make it consistent with a pre-assigned term structure of interest rates and possibly volatilities. The most general approach is in Maghsoodi (1996). A more tractable approach is in Brigo and Mercurio (2001b) where an external time-dependent shift is added to the model for consistency with an input term structure of rates. A significant extension of the CIR model to the case of stochastic mean and stochastic volatility is given by Lin Chen(1996) and is known as Chen model. A CIR process is a special case of a basic affine jump diffusion, which still permits a closed-form expression for bond prices.

See also

References

- Hull, John C. (2003). Options, Futures and Other Derivatives. Upper Saddle River, NJ: Prentice Hall. ISBN 0-13-009056-5.

- Cox, J.C., J.E. Ingersoll and S.A. Ross (1985). "A Theory of the Term Structure of Interest Rates". Econometrica 53: 385–407. doi:10.2307/1911242.

- Maghsoodi, Y. (1996). "Solution of the extended CIR Term Structure and Bond Option Valuation". Mathematical Finance (6): 89–109.

- Damiano Brigo, Fabio Mercurio (2001). Interest Rate Models — Theory and Practice with Smile, Inflation and Credit (2nd ed. 2006 ed.). Springer Verlag. ISBN 978-3-540-22149-4.

- Brigo, Damiano and Fabio Mercurio (2001b). "A deterministic-shift extension of analytically tractable and time-homogeneous short rate models". Finance & Stochastics 5 (3): 369–388.

|

|||||||||||||||||||||||